How to Invest in Cold-Chain Logistics for Perishable Exports in Tanzania

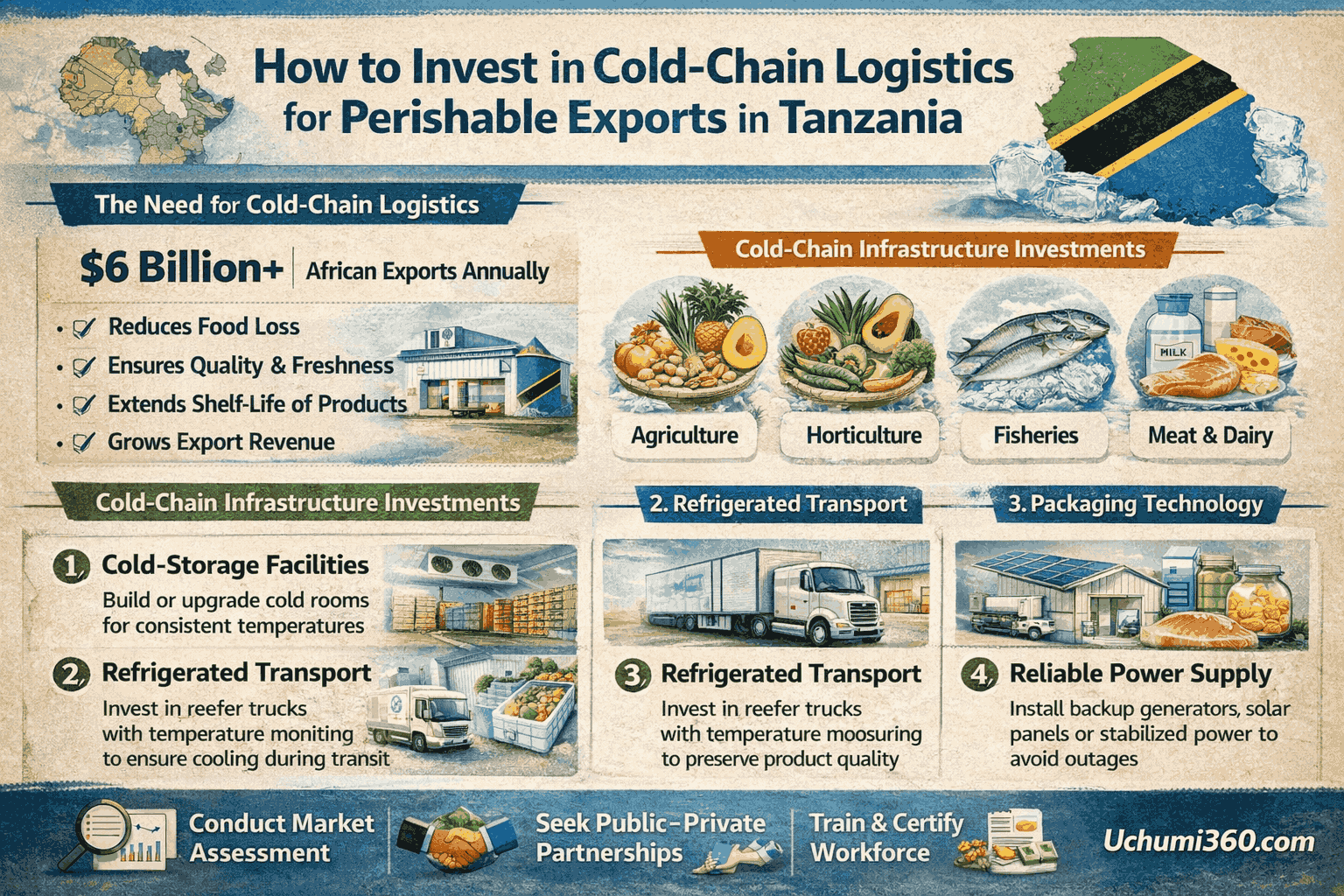

Cold-chain logistics is emerging as a critical enabler of Tanzania’s export competitiveness. With rising regional and international demand, investment in temperature-controlled storage, refrigerated transport, and pack-house facilities is becoming both commercially viable and strategically necessary.

Tanzania’s agricultural sector is growing rapidly, yet a large share of high-value perishable produce never reaches premium export markets in optimal condition. From horticulture and fish to meat and dairy, post-harvest losses remain one of the largest hidden costs in the export economy. For investors, this is not just a supply chain gap, it is a structured opportunity.

Cold-chain logistics is emerging as a critical enabler of Tanzania’s export competitiveness. With rising regional and international demand, investment in temperature-controlled storage, refrigerated transport, and pack-house facilities is becoming both commercially viable and strategically necessary.

Why Cold-Chain Investment Matters

Tanzania produces substantial volumes of fruits like (Avocados, Mangoes) Green beans, Flowers, Fish from Lake Victoria, Poultry and beef. Without proper cold storage and refrigerated transport, a significant portion of this produce loses value before reaching Dar es Salaam port or Julius Nyerere International Airport. Post-harvest losses can reach 20 - 40%, affecting: Agribusiness profitability, Farmer incomes, Export revenue, Market reputation

Cold-chain logistics strengthens: Export competitiveness, Food safety compliance, Quality certification for EU and Middle East markets, Supply chain efficiency.

For Tanzania to scale agro-processing and export diversification, logistics infrastructure must evolve alongside production growth.

Understanding the Cold-Chain Value Chain

Investors need to understand the full cold-chain ecosystem:

- On-farm pre-cooling systems

- Collection and aggregation centers

- Cold storage warehouses

- Refrigerated transport (reefer trucks)

- Airport and port cold handling facilities

- Export documentation and customs clearance

You do not need to own the entire chain. Many successful investors focus on one high-demand segment, such as pack houses or temperature-controlled warehouses near production clusters.

Entry Points for Investors

1. Solar-Powered On-Farm Cold Rooms

Regions like Arusha, Kilimanjaro, Mbeya, and Njombe are ideal for modular solar-powered cold rooms.

Benefits:

- Reduce reliance on unreliable grid electricity

- Scalable for smallholder cooperatives

- Supports rural development and climate-smart agriculture

This segment is suitable for investors seeking moderate capital exposure with measurable impact on reducing post-harvest losses.

2. Aggregation Cold Hubs

Cold storage hubs near production clusters allow:

- Grading and sorting

- Packaging for export markets

- Compliance with food safety standards

- Volume consolidation for better pricing

High-potential regions:

- Arusha (horticulture & flowers)

- Mwanza (fisheries)

- Mbeya (avocados & potatoes)

- Morogoro (fruits & vegetables)

Tips: Secure long-term supply agreements and consider PPP or joint venture models to reduce risk.

3. Refrigerated Transport Services

Reefer truck leasing remains underdeveloped in Tanzania. Reliable refrigerated transport improves:

- Supply chain reliability

- Export turnaround times

- Reduction in spoilage

- Overall logistics efficiency

Opportunity: Fleet financing or structured leasing arrangements can lower barriers for investors while meeting export demand.

Financial Considerations

Cold-chain investment requires moderate to high capital expenditure:

- Refrigeration equipment and insulated panels

- Backup power systems

- Temperature monitoring technology

- Land acquisition or facility leasing

Revenue streams are predictable due to:

- Long-term supply contracts

- Growing export demand

- Expansion of supermarkets and agro-processing

Tip: Conduct feasibility studies focusing on production volumes within a 50–100 km radius. Blended finance (equity, loans, incentives) enhances project bankability.

Regulatory and Policy Environment

Tanzania supports logistics investment through:

- The Tanzania Investment and Special Economic Zones Authority (TISEZA) incentives

- Special Economic Zones (SEZ) & Export Processing Zones (EPZ)

- Tax incentives for strategic infrastructure

- Growing AfCFTA market access

Compliance is essential for export markets:

- Tanzania Bureau of Standards (TBS)

- International food safety certifications

- Phytosanitary documentation

Investors should also assess:

- Electricity reliability

- Road and port infrastructure

- Customs and documentation processes

Risks and Mitigation

Key risks include:

- Power outages and energy costs

- Maintenance capacity

- Skilled workforce availability

- Currency fluctuations

- Seasonal production variability

Mitigation strategies:

- Hybrid solar-grid systems

- Maintenance contracts

- Workforce training programs

- Diversified client portfolios across crops

- Multi-year supply agreements

Strategic Investment Approach

- Focus on a high-output production cluster

- Partner with established exporters

- Secure supply agreements before construction

- Integrate digital temperature tracking

- Align with export financing institutions

Cold-chain logistics is not just storage, it is part of Tanzania’s broader export infrastructure strategy.

The Bigger Picture

Tanzania aims to grow non-traditional exports and strengthen its position in regional and global markets. Cold-chain investment supports:

- Agribusiness growth

- Export diversification

- Trade competitiveness

- Industrialization strategy

- Food security

With regional demand for fresh produce increasing, early investors stand to benefit from long-term structural demand. The transformation of Tanzania’s perishable exports will be driven not only by farmers, but by infrastructure investors who recognize that preservation equals profitability.