AfCFTA in Practice: A Strategic Roadmap for Tanzanian Exporters

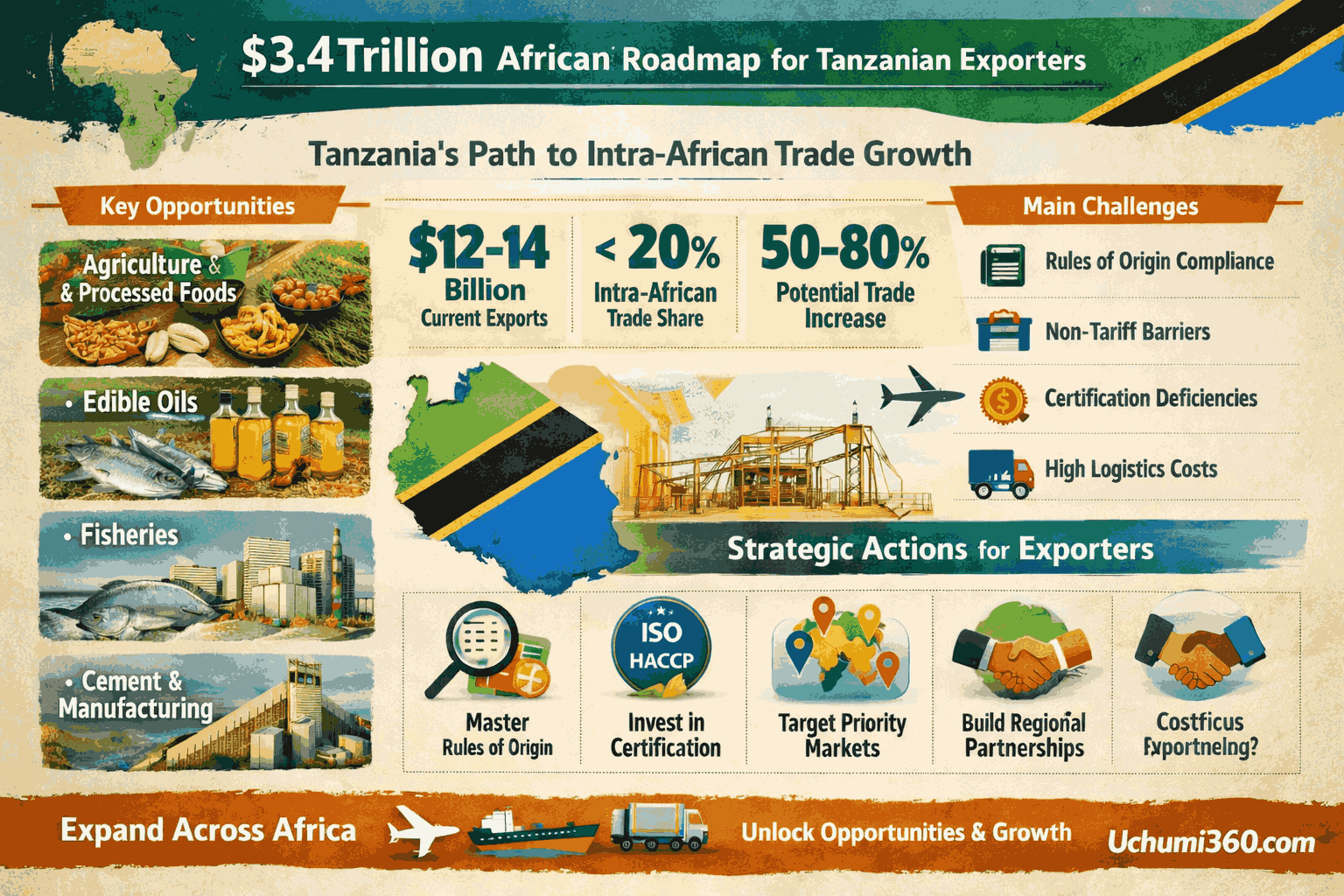

For Tanzania, it opens access to a combined African market of over 1.3 billion people with a collective GDP exceeding USD 3.4 trillion. By progressively eliminating tariffs on 90% of goods traded within Africa, AfCFTA has the potential to increase intra-African trade by an estimated 50–80% over the next decade.

The African Continental Free Trade Area (AfCFTA) represents one of the most significant economic integration efforts in modern history. For Tanzania, it opens access to a combined African market of over 1.3 billion people with a collective GDP exceeding USD 3.4 trillion. By progressively eliminating tariffs on 90% of goods traded within Africa, AfCFTA has the potential to increase intra-African trade by an estimated 50–80% over the next decade. For Tanzania whose exports are still heavily concentrated in a limited number of regional markets this agreement is not simply a diplomatic milestone; it is a concrete commercial opportunity.

However, market access on paper does not automatically translate into export growth. Tanzania’s total merchandise exports currently stand at roughly USD 12 - 14 billion annually, with a significant share going to traditional partners such as India, China, the UAE, and neighboring East African Community (EAC) countries. Intra-African trade still accounts for less than 20% of Tanzania’s total exports. AfCFTA offers the possibility to diversify beyond immediate neighbors into West, Central, and Southern Africa but only if firms and policymakers adopt deliberate, strategic action.

Where the Opportunity Lies

Tanzania holds clear competitive advantages in several high-demand sectors across the continent. Agriculture remains central, contributing roughly 25–30% of GDP and employing nearly two-thirds of the population. Processed agricultural goods including coffee (over 60,000 metric tons annually), cashew nuts (among Africa’s top producers), tea, cloves, and spices already have continental brand recognition. Moving further up the value chain into roasting, packaging, and branded exports could significantly increase export earnings.

Horticulture is another fast-growing sector. With expanding middle-class populations in countries such as Nigeria, Ghana, Côte d’Ivoire, and Angola, demand for fresh fruits, vegetables, and processed foods continues to rise. Africa’s food import bill exceeds USD 40 billion annually, indicating substantial unmet demand within the continent itself.

Edible oils present a particularly strong opportunity. Many African countries import large volumes of palm and sunflower oil from outside the continent. Tanzania’s sunflower production capacity is expanding, and with targeted investment, it could capture a larger regional market share.

Fisheries especially from Lake Victoria and the Indian Ocean — offer additional export growth potential. Processed fish products already reach European markets; similar quality standards could allow expansion into urban African retail chains.

Beyond agriculture, Tanzania’s cement production capacity exceeds 7 million metric tons annually, with surplus output available for export. As infrastructure investment accelerates across Africa particularly in West Africa cement and selected manufactured goods could see steady demand growth.

The Real Barriers

Despite tariff reductions under AfCFTA, structural challenges remain significant. Tariffs may fall, but operational inefficiencies can still erode competitiveness.

Rules of origin compliance is one of the most immediate technical barriers.

To qualify for preferential tariffs, products must meet specific local content thresholds. Firms that rely heavily on imported inputs may struggle to meet these requirements without proper documentation systems.

Non-tariff barriers (NTBs) remain pervasive across the continent.

These include licensing delays, customs bottlenecks, inconsistent application of standards, and administrative fees. In some African ports, cargo dwell times can exceed 10–20 days, compared to global best practice of under 5 days. Such delays increase costs and reduce product freshness for perishable goods.

Standards and certification gaps also limit market access.

Many Tanzanian SMEs lack internationally recognized certifications such as ISO, HACCP, or GlobalG.A.P., which are increasingly required by supermarket chains and institutional buyers across Africa.

Logistics inefficiencies further constrain competitiveness.

While Tanzania has invested heavily in port and rail upgrades including the Standard Gauge Railway transport costs can still represent up to 30 - 40% of final product value for some exporters.

Access to trade finance remains limited.

SMEs often face high interest rates and stringent collateral requirements, making it difficult to scale production for export orders.

Strategic Actions for Exporters

To benefit meaningfully from AfCFTA, Tanzanian exporters must adopt focused and disciplined strategies.

1. Master Rules of Origin

Firms must fully understand the specific origin requirements for their product categories. This involves calculating local value addition percentages, documenting sourcing patterns, and maintaining transparent production records. Establishing internal compliance systems — or working closely with customs brokers and trade consultants — is essential. Without compliance, exporters risk losing preferential treatment and facing standard tariff rates.

2. Invest in Certification Early

Certification is no longer optional for firms targeting higher-value African markets. Exporters should allocate dedicated budgets for obtaining ISO, HACCP, or sector-specific certifications. Staff training in quality management systems is critical, as is partnership with accredited local testing laboratories. While certification may require upfront costs ranging from USD 5,000 to USD 25,000 depending on scale, it significantly improves access to formal retail and institutional buyers.

3. Target Specific Markets, Not “Africa”

Africa is not a single market. Successful exporters should identify two or three priority countries based on demand data, income levels, logistics routes, and competitive landscape. For example, a sunflower oil producer might target the Democratic Republic of Congo, Zambia, or Malawi based on proximity and consumption patterns. Conducting pricing benchmarks and competitor analysis in each target market reduces risk and improves entry success.

4. Strengthen Regional Partnerships

Entering distant African markets without local knowledge increases commercial risk. Forming joint ventures, appointing reliable distributors, or partnering with established wholesalers provides market intelligence and reduces regulatory uncertainty. Strategic partnerships also help navigate local consumer preferences and payment systems.

Policy Recommendations

While firms must act decisively, policy support is equally important. To maximize AfCFTA gains, Tanzania should accelerate full digitization of export documentation to reduce processing times and minimize bureaucratic friction. Continued reduction of port dwell times aiming for below 7 days consistently would significantly enhance competitiveness.

Expanding export credit guarantees and trade finance facilities, particularly for SMEs, would unlock production capacity. Establishing dedicated AfCFTA export advisory desks could provide technical guidance on rules of origin, certification requirements, and market intelligence.